How to Build An Emergency Fund

Building an emergency fund is essential to long-term financial security (and winning at adulthood). Learn how to start your own emergency fund today.

Adulting is hard. Like seriously hard.

In November 2019 my boyfriend and I’s apartment flooded.

From our kitchen to our bathrooms to even our living room, our apartment was covered in sewer water.

It was too much to pay our $1,000 renters insurance deductible to cover the damage, so we had to pay for all new bathmats, toiletries, and towels from our own pockets.

Luckily, we had built up an emergency fund and it saved us big time *literally*!

When you build an emergency fund, you are setting yourself up for success in adulthood.

An emergency fund is such an essential part of your personal finance journey and creating security for your future self.

If you do not know how to build an emergency fund or even what an emergency fund is, you have come to the right blog post!

In today’s blog post I am sharing a step-by-step guide to building an emergency fund.

This guide is perfect for new money-savers or those who have attempted to build an emergency fund and did not find success.

- Building an emergency fund is essential to long-term financial security (and winning at adulthood). Learn how to start your own emergency fund today.

- What is an emergency fund?

- Why do I need an emergency fund?

- What if I am paying off debt, should I still build an emergency fund?

- How much do I need in my emergency fund?

- How do I build an emergency fund? 7 simple steps

- How to stop spending your emergency fund and save more money. 6 actionable tips.

- Concluding thoughts on starting your own emergency fund

- Thanks for reading about how to start an emergency fund.

*This post may contain affiliate links. Purchasing a product or service through an affiliate will earn me a small commission at no additional cost to you. Please read our Disclaimer Policy for more information about the use of affiliate links on this site.

What is an emergency fund?

An emergency fund, sometimes called a rainy day fund, is a specific fund you set aside money towards and use for expenses related to an emergency situation.

However, you need to be careful about how you define “emergency.”

It is easy to use your emergency fund when you are low on cash and need to pay off a non-emergent bill.

But that is not what your emergency fund should be allocated towards.

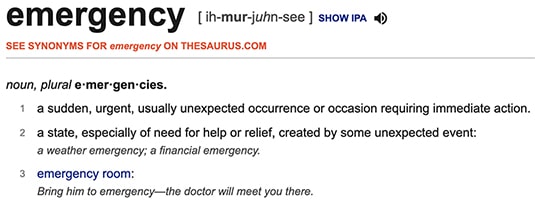

Dictionary.com defines emergency as:

Take note of the word “unexpected.” An emergency and what your emergency fund should be used for is an event that you were unable to plan for.

Situations that can be defined as an emergency include, but are not limited to:

- Sudden job loss

- Medical emergency (e.g., heart attack, stroke, emergency surgery, a broken bone, etc.)

- Car accident

- Natural weather emergency (e.g., tornado/hurricane, flooding, mudslide, earthquake, etc.)

- Stolen personal property

- Lawsuit/legal emergency

- Sudden loss of a family member, significant other, or pet

In summary, if you are able to plan for the expense, you should not be using your emergency fund to pay for that expense. Instead, you should be budgeting for it!

Why do I need an emergency fund?

Saving towards and having an emergency fund prevents you from having to withdraw money from your checking account or other financial account(s) to pay for an unplanned event.

It also prevents you from having to use a credit card, personal loan, or payday loan to pay for emergency expenses, and as a result, lessens the chance of you falling into serious debt.

Having an emergency fund will also give you a peace of mind and security no matter what the future holds.

And especially in today’s world who knows what is going to happen next!?

What if I am paying off debt, should I still build an emergency fund?

Yes and a million times YES, you should build an emergency fund even if you are in debt.

Whether you trying to pay down medical bills or student loans you should make building an emergency fund a top priority and not an “I’ll do it later” priority.

Saving towards an emergency fund can even prevent you from falling deeper into debt because you have the money or at least a portion of the money to pay towards an emergency expense, and thus lessening the financial burden.

Even if you can set aside 5% of each paycheck towards an emergency fund it will make a huge difference down the line at the chance life doesn’t go your way.

How much do I need in my emergency fund?

When you are learning about how to build an emergency fund it may seem intimidating hearing about people having a $20,000 emergency fund. But don’t get too caught up in what other people are doing with their emergency fund.

Like every person, every emergency fund is unique.

Everyone has different monthly expenses, priorities, and lifestyles.

A frugal individual may need less of an emergency fund than someone who loves dining out and getting Starbucks 3x a week.

There is no one-size fits all emergency fund goal amount you need to hit to finally feel secure.

However, there is a general rule of thumb to help you get started: 3 to 6 months worth of expenses.

For example, if your monthly expenses are $2,000 (this includes rent, food, gas, clothes, entertainment, pets, etc.) then you would want to have a $6,000 3-month emergency fund or a $12,000 6-month emergency fund.

Before you get overwhelmed, start saving towards the smaller amount, the 3-months worth of expenses, and then work towards 6-months of expenses when you’ve reach your 3-month goal.

It can be daunting and painful looking at your emergency fund slowly creeping up towards the goal amount.

So start off with a small emergency fund goal to get used to putting aside money every paycheck or month.

Once you hit your 3-months worth of expenses you will hopefully feel the rush of saving money and have the desire to continue the money saving habit until you hit your 6-month goal.

How do I build an emergency fund? 7 simple steps

1. Calculate how much money you need in your emergency fund

The first step to building an emergency fund is to calculate how much money you need (in total) in your emergency fund to be “fully funded.”

I would go ahead and calculate how much you need to save up to have to 3-month emergency fund and 6-month emergency fund. Heck, go ahead and calculate a 1-year emergency fund while you’re at it!

When you are calculating how much you need to build an emergency fund, consider all monetary expenses in a typical month. Even dig around a little in your bank statements to get an even clearer picture.

Remember to include these in your monthly expenses:

- Rent/mortgage

- Groceries

- Gas and other utilities

- Insurance

- Pets (if applicable)

- Kids (if applicable)

- Clothes

- Medication

If you are trying to be “frugal” with your emergency fund, try to keep “non-essential” expenses out of your emergency fund calculations since in emergent times it probably is not the best idea to continue your Starbucks habit.

Once you have calculated your monthly expenses, multiply that number by 3 to calculate your 3-month emergency fund goal, by 6 to get a 6-month emergency fund goal, and 12 to get a 1-year emergency fund goal.

For example, if your monthly expenses were $3,000 then:

3-month emergency fund: $3,000 x 3 = $9,000

6-month emergency fund: $3,000 x 6 = $18,000

1-year/12 month emergency fund: $3,000 x 12 = $36,000

2. Open up a separate bank account specifically for your emergency fund

If you are a habitual spender I would highly recommend opening a separate bank account at a different financial institution for your emergency fund.

By opening up a separate bank account in a different financial institution you are less likely to withdraw money from your emergency fund since the time to transfer the money would not be worth it for an impulse buy.

Also, it is easier to “ignore” because you not be looking at the money every single day like you would for your normal checking account.

NerdWallet has a great blog post on the best high-yield savings accounts you can open up, which would be perfect for your emergency fund!

If you are more disciplined, you can open up a separate bank account at the financial institution you are currently with.

Regardless of where you store your emergency fund, make sure that the account is easy to access and transfer money in and out of. If you are in an emergency situation you do not want to be waiting days or even hours to get your money.

3. Figure out how much you will allocate towards your emergency fund on a consistent basis

To build an emergency fund you have to be dedicated to the process of building it up.

That means allocating money towards your emergency fund on a consistent basis that works with your financial situation.

There are a two ways you can approach this:

- Set aside a specific amount each week, each paycheck, or every month.

- Set aside a percentage of each paycheck.

If you choose approach #1 you’ll need to be able to dedicate yourself to that amount every interval. It is kind of like a Netflix subscription, except you are subscribing to your future security!

This is a great option if you have a salaried job or non-variable income.

If you choose approach #2 you’ll need to do a little bit of math each time your paycheck comes through.

However, this is a great option if you are not salaried and your pay varies depending on how many hours you work, if you received commission, or tips.

Let’s say your next paycheck is $1,500 and you want to put aside 15% of your paycheck towards building your emergency fund.

You’d multiple $1,500 by 0.15 to get the amount you’re allocating towards your emergency fund from your paycheck.

$1,500 x 0.15 = $225

I personally do approach #2.

Every paycheck I receive I allocate 20% of it to my emergency fund without fail.

If your paycheck is already small, you can choose a smaller percentage like 10% or 5%.

4. Set up recurring transfers or “rules” for saving

When you start to build your emergency fund you need to get into the habit or mindset of saving money.

The best way to do this is to set up recurring transfers or find a savings account that lets you set up “rules” for saving.

Setting up recurring transfers or “rules” makes building an emergency fund automatic.

You set up these transfers or rules once and then you don’t have to think about it again!

Your bank should have a way to set up automatic, recurring transfers. If you are unsure call your bank or try using their online support features to get started.

Below you can find money transfer FAQ’s for popular banking institutions:

You can also find a mobile app that will allow you to set up “rules” to help you save money.

“Rules” act like a regular recurring transfer, but they can be more complex than your standard bank transfer.

For instance, the app Qapital (I’ve been using it religiously since 2015), allows you to set up funding “goals” on one bank account.

You can set up an emergency fund goal and create rules that automatically help you save money and build your emergency fund.

Currently Qapital offers the following “rules”:

- Set and forget

- Payday

- Round up

- Guilty pleasure

- Spend less

- Freelance

- 52 week rule

- Apple health

- Rules powered by IFTTT

I personally LOVE the round up and payday/freelance rule (they’re the same thing essentially!)

The round up rule allows you to round up each purchase you make to a certain dollar amount (e.g., you spent $4.90 on a coffee and Qapital automatically rounds up the purchase to $5.00, so you automatically get 10 cents transferred from your bank to your emergency fund goal in Qapital).

The payday and/or freelance rule allows you to allocate a certain percentage of each paycheck over a certain amount towards your goal in Qapital. For example, if your paycheck is over $200 then it will transfer 20% of that paycheck from your bank into your emergency fund goal in Qapital.

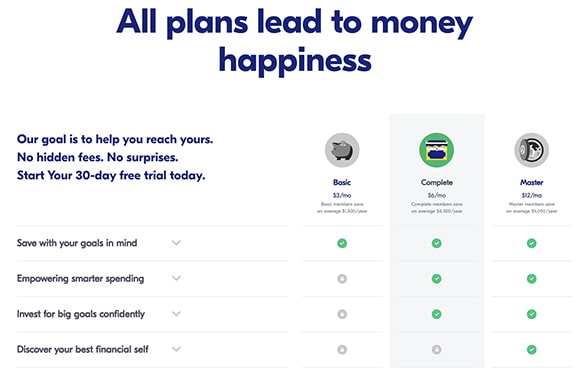

Unfortunately, Qapital is not free. You do have to pay a monthly membership fee, but I truly believe all the features and flexibility of Qapital makes it totally worth the small monthly investment.

You can get started using Qapital today using my referral link. Signing up for Qapital through my referral link will give you $25 to start with, which will already get you started on building your emergency fund.

6. Be patient and watch your budget!

Building an emergency fund is a slow, long-term game.

Unless you suddenly inherit a bunch of money or get an extravagant bonus at work, it will take several months to several years to create a fully funded 3-6 month emergency fund.

But if you want to truly build an emergency fund, you need to be patient and be careful with how you spend your money. These two go hand-in-hand!

Developing patience for your emergency fund takes time, especially if you are new to saving money and there is no direct/dire emergency.

Seeing your emergency fund hold $1,500 and not being able to spend it is frustrating. You know you can’t take it out, but you have a huge desire to just spend it and receive instant gratification!

Be patient!

I promise you, you will thank yourself for waiting especially when a true emergency comes along.

As you build patience for saving money, hopefully you will start to appreciate and actually enjoy the saving money process too. Saving money can even be addicting at times!

However, to develop patience you also need to curb your spending habits if they are going off the rails.

If you are not currently tracking your spending through an app or spreadsheet–you need to! If you overspend, it will be so difficult to build an emergency fund because you will be constantly digging into it to pay your bills.

Take some time to analyze your spending.

Figure out where you’re spending too much and too often.

Try to limit how much you eat out, see if you can reduce your grocery bill or utilities, and find ways to spend time with friends and loved ones without having to spend money.

In the next section, we will talk about how to stop spending your emergency fund.

How to stop spending your emergency fund and save more money. 6 actionable tips.

1. Set up boundaries

Just like a relationship you need to set boundaries with your emergency fund.

Think of your emergency fund and you as being in a long-term relationship/marriage.

Take a moment and jot down your own definition of “emergency” – what does emergency mean to you?

And take some time to set up boundaries for how often you check your emergency fund balance.

By setting up automatic transfers with your bank or with Qapital, you don’t have to constantly be checking up on your emergency fund, which as a result, can lessen the desire to see how much money you have in your emergency and potentially spend it.

However, you need to check up on your emergency fund every once in awhile to make sure transfers are going through successfully and no one has hacked into your account and taken all your money.

So figure out how often you want to check your emergency fund balance.

Is it every week? Bi-weekly? Once a month?

You decide, but make sure when you check up on your emergency fund your only intention is to just check up on it and not hit the transfer button.

2. Be forgiving of yourself, but not too lenient

Your journey to building an emergency fund is a long one.

It isn’t all smooth sailing at at times and you may find yourself spending your emergency fund in a non-emergent situation.

And that’s ok!

Be forgiving of yourself during this journey.

It takes time to develop a money saving mindset and life happens.

However, don’t make transferring money out of your emergency fund a habit.

That’s why you set boundaries!

If you find yourself habitually taking money out of your emergency fund once a month to cover bills, it may be time to go back to the drawing board. You may need to reassess your spending habits, your budget, and boundaries for your emergency fund.

3. Find ways to treat yourself without spending money

Who said that treating yourself had to involve spending money?! There are plenty of ways (just Pinterest or YouTube it) to treat yourself for free.

Here are some suggestions:

- Take a nice long hot bath

- Have an at home movie or TV show binge night

- Go outside for a walk or jog

- Paint your nails at home

- Read a book you’ve been dying to read

- Do an at home facial

- Meditate

4. Keep a habit tracker

If you are an avid spender, with a desire to build an emergency fund, you need to curb your spending big time.

However, it can be hard to break habits that are just so dang satisfying.

I mean who doesn’t love the feeling of opening up another unnecessary Amazon package?!

One way to curb your spending is to create or purchase a visual habit tracker for your spending. Each day you spend money you’ll color in a box.

Utilize your habit tracker for one month and at the end of the month take some time to reflect on how many times you spent money that month. You may be surprised how often you are spending money!

After reflecting on the results, look at your finances and see if there are ways you can decrease how often you spend money in a month.

5. Find someone to keep you accountable

It can be hard to build an emergency fund on your own.

As mentioned earlier, building an emergency fund a long-term game and you may need more than just willpower to get you to your 3-6 month emergency fund goal.

Finding an accountability buddy, like a significant other or best friend, can help motivate you to stay in the emergency fund building game.

Maybe your accountability buddy and you can start a money savings challenge together (more on that below) or “compete” against each other and see how long you can go without getting an iced coffee to-go from Starbucks.

6. Start a money savings challenge

Building an emergency fund can be quite boring.

It can also be difficult simply getting into the habit of saving money.

Starting a money savings challenge can help motivate you, get you used to saving money, and teach you how to be a more patient money saver.

If you search on Pinterest there are a ton of different money challenges to fit all types of lifestyles and budgets.

One of my favorites is the 52-week savings challenge.

The 52-week savings challenge has you setting aside an extra dollar (starting at $1) per week for a whole year.

For example, the first week you set aside $1 (easy right?!), the second week $2, the third week $3, and so forth.

As you go through the year your savings will exponentially increase your emergency fund until you get to the grand total of $1,378 saved. You can do the challenge in increasing increments or decreasing increments, whichever you prefer.

Other money savings challenges you can try:

- No-spend weekend/week

- No-spend on a particular day of the week

- $10,000 in 52 weeks by Not A Worker Bee

- 26 Paycheck Challenge by Simple Money Mom

- $1000 emergency savings plan by Fitnancials

- 12-month emergency fund challenge by The Extra Income Project

Concluding thoughts on starting your own emergency fund

Building an emergency fund is the key to financial security as an adulting.

When you have an emergency fund you are giving yourself the opportunity to continue to thrive even if disaster strikes.

If you do not already have an emergency fund or fell off the emergency fund bandwagon, I challenge you to start today.

And don’t worry about saving a lot. Just start small and work towards building the habit of setting aside money for your emergency fund. You got this!

Save this blog post to read or refer back to later by clicking the Pinterest share button below this image.